Introduction

In a remarkable industry shift, Nvidia has overtaken Apple to claim the title of the world’s second-most valuable company. Driven by surging demand for artificial intelligence (AI) hardware, Nvidia’s market valuation surpassed the $3.53 trillion mark, edging past Apple’s $3.52 trillion. With only Microsoft holding a higher valuation, Nvidia’s rapid ascent reflects the expanding role of AI in global technology markets. This post explores Nvidia and Apple’s financial performances over the past year, their recent strategic alliances, and the factors distinguishing their market positions.

Nvidia’s Financial Growth and AI Momentum

Nvidia’s share price has experienced explosive growth over the past year, driven largely by the booming need for AI-related hardware. In recent months, Nvidia’s stock rose by 24% following impressive quarterly earnings reports. The company, which specializes in GPUs (graphic processing units) crucial for AI applications, has seen its products become essential in sectors ranging from data analysis to healthcare. Nvidia’s latest financial report showed a net income of $14.9 billion on revenue of $26 billion—a substantial leap, underscoring the company’s evolution into an AI leader.

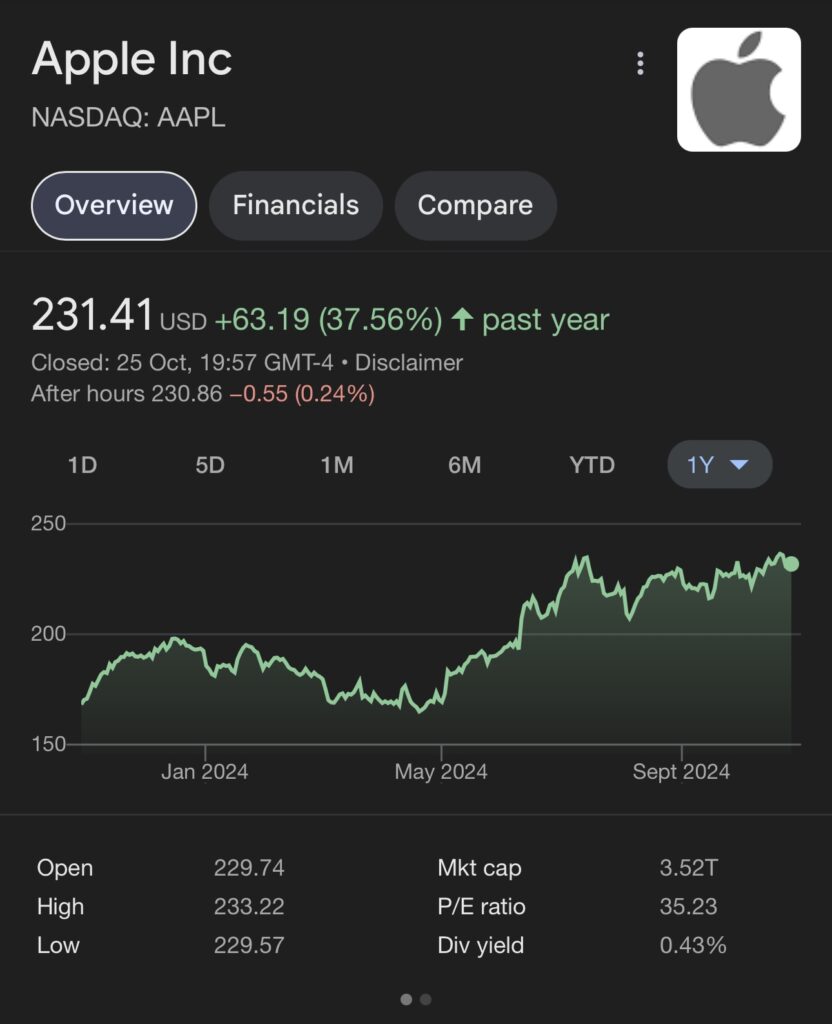

Apple’s Steady Progress and Market Challenges

Apple, although still a formidable player, has encountered slower growth due to its reliance on consumer electronics, an area that currently lacks the rapid expansion seen in AI. Apple’s flagship product, the iPhone, has had only modest upgrades recently, and while its services and wearables divisions are growing, they haven’t matched Nvidia’s AI-driven acceleration. Over the past year, Apple’s share returns have been strong but haven’t matched Nvidia’s sharp upward trajectory. This comparison highlights AI’s impact on current valuations.

Strategic Partnerships in the Past Year

Both companies have secured key partnerships over the past year to strengthen their positions. Nvidia has deepened its relationships within the AI field, collaborating with Microsoft and Oracle to expand its data center capabilities and support AI projects at scale. These partnerships allow Nvidia to leverage Microsoft Azure and Oracle’s cloud infrastructure to enhance its AI offerings.

Meanwhile, Apple has maintained its focus on reinforcing its hardware and services ecosystem. Through partnerships with Broadcom for 5G technology and other component suppliers, Apple has continued to invest in enhancing its existing platforms. However, unlike Nvidia, Apple has not made significant moves into the AI hardware sector, a field that Nvidia is increasingly dominating.

Key Differences in Market Approach: Consumer vs. Enterprise Focus

The fundamental difference in Nvidia and Apple’s strategies lies in their market focus. Nvidia’s strength is in enterprise applications, particularly in AI, data centers, and high-performance computing. Its AI-centric GPUs are pivotal for training and deploying large models, which have become critical for many industries beyond tech.

Apple, by contrast, is heavily consumer-focused. Its revenue is driven by products like the iPhone, Mac, and Apple Watch, creating a tech ecosystem recognized for its seamless user experience and privacy features. While Apple’s dominance in consumer technology remains strong, the rapid rise of enterprise AI applications presents new challenges as the tech landscape shifts.

What This Shift Means for Investors and the Tech Industry

Nvidia’s recent valuation surge, surpassing Apple, reveals broader industry trends as the AI revolution gains momentum. Investors are increasingly recognizing Nvidia as a key player within this space, especially as partnerships with major cloud providers fuel its growth in enterprise AI infrastructure.

For Apple, this change is a reminder of the importance of diversifying and innovating beyond its current product suite. While Apple continues to improve its ecosystem and user experience, its future growth may hinge on expanding into AI-driven products and services to stay competitive with enterprise-focused tech giants like Nvidia.

In summary, Nvidia’s rapid rise underscores the potential of AI and enterprise technology. Apple, on the other hand, remains a powerful consumer brand, but the continued evolution of AI could push it to expand its focus. As these companies navigate this evolving industry landscape, they will both face unique challenges and opportunities that may redefine their positions in the years ahead.

Conclusion

Nvidia’s overtaking of Apple is a testament to the growing value placed on AI-driven innovation. For Apple, it serves as a call to explore opportunities beyond consumer electronics. As Nvidia forges ahead in enterprise AI, and Apple continues its stronghold on consumer tech, the coming years will be pivotal in shaping the paths of both companies in an increasingly AI-focused world.

This blog combines up-to-date data on market valuations, recent share performances, and key partnerships to provide a thorough look at Nvidia’s rise and the evolving role of AI in technology. This industry shift emphasizes the divergence between Nvidia’s enterprise AI focus and Apple’s consumer-centric approach.